According to MarketSmith founder and legendary investor William J. O’Neil, the first step in learning how to pick big stock market winners is to examine leaders of the past. From these observations, you will be able to recognize the characteristics these stocks had just before their spectacular price advances.

Toward that goal, O’Neil completed a comprehensive study of the greatest winning stocks spanning the past 125 years. He then put together a set of common characteristics to these past market leaders and coined the term CAN SLIM. Each letter stands for one of the seven chief characteristics of these greatest winning stocks, just before they made huge profits for their shareholders.

It’s this philosophy that helped O’Neil become the youngest person at the time to buy a seat on the New York Stock Exchange. It’s also the same philosophy that allowed our Hong Kong 33 List return over 60% in 2013 vs. the Hang Seng’s 2.9% gain. The reason CAN SLIM continues to work cycle after cycle in countries throughout the globe is that it’s based solely on the reality of how the stock market actually works rather than personal opinions. Human nature at work in the market simply doesn’t change.

C: Current Earnings

Look for stocks with big earnings in their latest reported period. The bigger, the better. Growth of at least 25% is a good starting point. You would also like to see earnings acceleration over the last three periods. For example, one period earnings may be up 25%, the next up 50%, and the most recent up 90%.

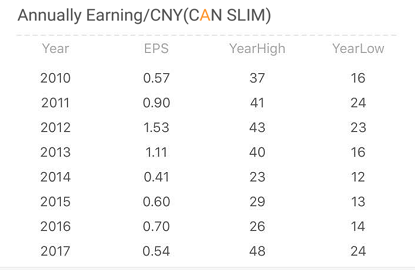

A: Annual Earnings

You want to see annual earnings growth of at least 25% for each of the last 3 years. We have also found that the greatest stocks of all time had the best margins in their industry group and return on equity of more than 17%.

N: The New Factor

The biggest CAN SLIM winners had something NEW! New products, new services, new leadership, new price high or a new condition in the industry. Another important factor is to look for newer companies. Our studies of the greatest stock market winners showed that 75% of them went public within the last 8 years.

S: Supply and Demand

One of the most basic economic principles is the law of supply and demand which is most sharply demonstrated in the stock market. Strong demand for a limited supply of available shares will push a stock price up. On the flip side, an oversupply of shares and weak demand will cause the price to sag.

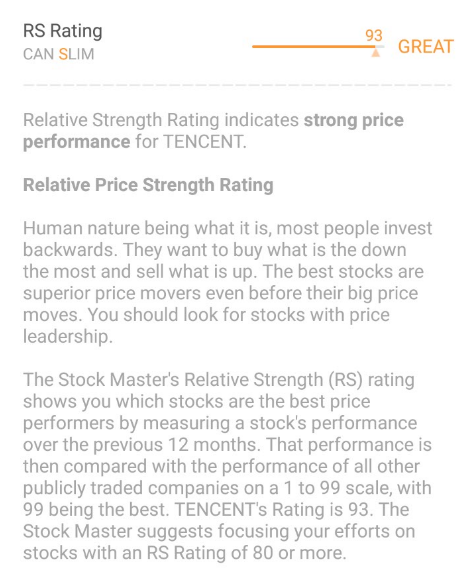

L: Leader vs. Laggard

True leaders are those companies showing the best earnings growth, strongest sales, superior price performance and are in LEADING industry groups. Consider buying high, and selling higher. The results from our study of the greatest market winners revealed something quite interesting in effect, the ‘strong got stronger.’ The task for astute investors is to locate these strong, leading companies and avoid the weak, laggard performers.

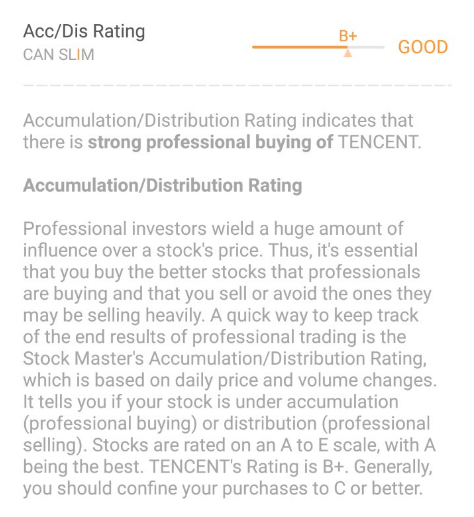

I: Institutional Sponsorship

Mutual funds, banks, and other professional investors are the big players that drive the market. For a stock to be a top performer, it must have institutional support to fuel its price moves. Monitor movements in heavy volume for signs that institutional investors are accumulating stocks.

M: Market Direction

Our study shows 3 out of 4 stocks follow the market’s trend, so you always want to trade in sync with the market. You should only be buying stocks in a confirmed uptrend and protect your capital in a correction.